Thursday, June 29, 2023

Wednesday, June 28, 2023

Tuesday, June 27, 2023

Monday, June 26, 2023

Friday, June 23, 2023

Thursday, June 22, 2023

Wednesday, June 21, 2023

Tuesday, June 20, 2023

Thursday, June 15, 2023

Wednesday, June 14, 2023

Hawkish Fed Falls On Deaf Ears

In what was perceived as a hawkish pause by the FOMC, fell on deaf ears shortly after the statement by the Federal Reserve was released Wednesday afternoon. Initially, after investors recognized the hawkish projections, interest rates quickly raced higher and stocks sold-off quite substantially. But that sentiment didn't last long, as US 10-year futures immediately recovered, spending the rest of the session grinding higher. As a result, key trendline support that originates off the March lows remains intact and if held in the immediate future could hint of a period of stability for interest rate futures. In terms of yields, the correlating trendline is even more apparent. The falling trendline (10-year yields) extends further back, connecting the highs from last October. Both trendlines will be keenly watched the rest of the week ahead of two key central bank meetings, namely the ECB and the BOJ. Stocks, meanwhile responded off post-statement release lows, allowing the NQ futures new front-month September (U) contract to reach fresh contract highs.

Tuesday, June 13, 2023

Monday, June 12, 2023

Friday, June 9, 2023

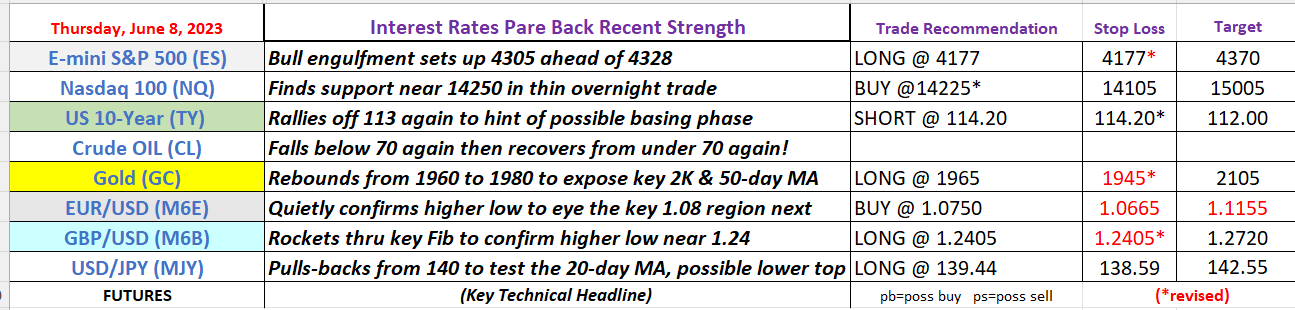

Thursday, June 8, 2023

Wednesday, June 7, 2023

Tuesday, June 6, 2023

Monday, June 5, 2023

Sunday, June 4, 2023

Strong Jobs Report Supports Rates, Dollar & Stocks

A better than-expected US jobs report buoyed stocks to new 2023 highs and rescued interest rates and the US dollar from weakness ahead of the Friday's non-payroll number. While the recent underperforming Dow Jones Industrials outperformed on Friday, the E-mini S&P 500 highlighted a clear breakout and NQ (Nasdaq 100 futures)made a marginal new year-to-date high. Once again, we face another situation of a huge move ending at the day and week's high. This represents a possible (buying) exhaustion of sorts that tends to mark potential near-term tops on the charts. Also, the rotation into recent under-performing sectors on Friday in itself is another reason to be cautious with stocks going forward as well. Another potential headwind for stocks could be rising interest rates and a stronger dollar. Although, both were down last week, both have been trending higher together over the past month. Renewed strength in either could further highlight weekly bullish continuation patterns and would strenthen headwind . That said, speculators sold ES futures heading into the jobs report once again, reaching another record short position according to the CFTC last week. Among the important technical levels to watch next week is whether the US 10-year yield will hold 3.70% and potentially break through 3.716%, the latest range midpoint. A succesfull break above could trigger a move in yields into the upper half of the May 26th to June 2nd range towards the recent 3.861% high).

Thursday, June 1, 2023

Dollar Woes Continues As Expectations For A Hike Pare Back

Interest rate expectations for the June 14th Federal Reserve meeting continue to pullback, affecting the both US dollar and bond yields adversely once again. It was a tough day for the Greenback, losing out across the board. This propelled gold futures towards 2k and oil back above 70. Stocks, meanwhile, soared on the first trading day of the month as E-mini S&P 500 futures reclaimed 4200 to potentially position bulls towards the 4325 region next. With a record short position by speculators, an upsddide breakout could usher in severe short covering given NQ futures are near new highs as well.

Subscribe to:

Posts (Atom)

-

While all eyes will indeed be glued to next week's Federal Reserve's statement and press conference on Wednesday, those viewing thro...

-

In what was perceived as a hawkish pause by the FOMC, fell on deaf ears shortly after the statement by the Federal Reserve was released Wedn...

-

Oil futures plunged back below 70 as traders returned from the holiday weekend. After taking out the psychological 70 threshold, bears manag...