Sunday, November 24, 2019

Tuesday, November 19, 2019

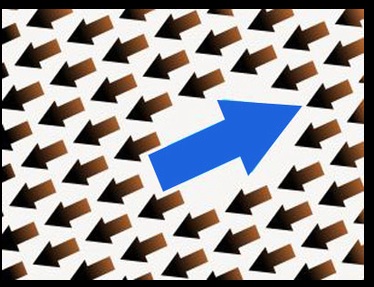

Speculators Continue To Favor Higher Oil Prices

According to the most recent Commitment of Traders (COT) report, as of last Tuesday (11/12), large speculators flipped back to buying US treasuries despite US equity markets extending recent strength to all-time highs. Meanwhile, the US dollar reversed lower by week's end after surging higher the week prior, highlighting a failure at a key midpoint for the Dollar Index. Large speculators continued to flee the Japanese yen and reversed out of the Australian dollar, neutralizing the recent bullish shift in sentiment. Oil & Gold speculators remained heavily long and positioning remained relatively unchanged for both the euro and British pound.

Tuesday, November 12, 2019

Dollar Index Dramatically Improves To Test Key Midpoint

The US dollar jumped last week after failing near the October low, marking a base in the process. The subsequent move up has retraced half of recent weakness and potentially highlights a (weekly chart) higher low. More importantly, the latest strength exposes key trendline resistance (monthly chart).

Saturday, November 9, 2019

Subscribe to:

Posts (Atom)

-

While all eyes will indeed be glued to next week's Federal Reserve's statement and press conference on Wednesday, those viewing thro...

-

In what was perceived as a hawkish pause by the FOMC, fell on deaf ears shortly after the statement by the Federal Reserve was released Wedn...

-

Oil futures plunged back below 70 as traders returned from the holiday weekend. After taking out the psychological 70 threshold, bears manag...