Wednesday, May 29, 2019

Monday, May 20, 2019

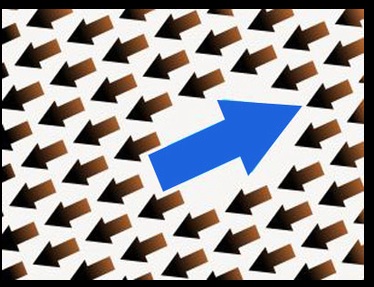

Risk Off Triggers More Yen Short Covering

According to the most recent Commitment of Traders (COT) report, as of last Tuesday's trade, large speculators continued to cover short bets against the Japanese yen amid heightened risk aversion due to trade tensions between the US & China. As a result, large speculators who had been heavily positioned for further yen weakness, piled out short contracts and added a substantial amount of long positions. Non-commercial traders also piled into gold futures, helping the yellow metal stabilize recent under-performance as the risk-off trade continues to linger. Speculative positioning in the US dollar continued to be mixed vs the major foreign currencies as the DXY Index continues to consolidate recent 2-year highs.

Sunday, May 12, 2019

Subscribe to:

Posts (Atom)

-

While all eyes will indeed be glued to next week's Federal Reserve's statement and press conference on Wednesday, those viewing thro...

-

In what was perceived as a hawkish pause by the FOMC, fell on deaf ears shortly after the statement by the Federal Reserve was released Wedn...

-

Oil futures plunged back below 70 as traders returned from the holiday weekend. After taking out the psychological 70 threshold, bears manag...