Wednesday, December 29, 2021

Monday, December 20, 2021

Weekly Sentiment Report (12/14)

The Japanese yen and British pound saw their sentiment readings dramatically recover in the most recent CFTC Imm report as of last Tuesday (12/14).

Friday, December 17, 2021

Wednesday, December 15, 2021

Monday, December 13, 2021

Weekly Sentiment Report (12/7)

Speculators have seemingly grown tired of following recent trends and the latest bearish shift in sentiment could hint of a larger, more significant shift in both price-action and sentiment.

Over the past few months speculators in ES & NQ futures have been buying (or going long), helping push both metrics to record highs. Even though the stock market has recovered off the recent pullback from record highs, the potential turn (lower) in sentiment could hint of a deeper move lower or a potential ongoing topping process in equity futures.

While minor shifts in sentiment alone don't often move the needle, especially with equity futures. Technically, the net long percentage for both ES and NQ should stabilize given how low the level of gross shorts are and how overbought bulls are currently.

Monday, December 6, 2021

Sunday, December 5, 2021

Weekly Sentiment Report (11/30)

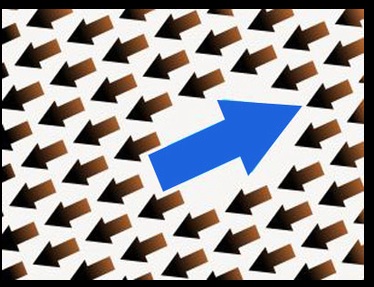

Typically so-called "large" traders or speculators trade alongside the ongoing trend, but according to the latest Imm report by the CFTC this isn't exactly true. In fact, short-term trends can and often do shift before speculators catch onto the momentum shift.

Thursday, December 2, 2021

Subscribe to:

Posts (Atom)

-

While all eyes will indeed be glued to next week's Federal Reserve's statement and press conference on Wednesday, those viewing thro...

-

In what was perceived as a hawkish pause by the FOMC, fell on deaf ears shortly after the statement by the Federal Reserve was released Wedn...

-

Oil futures plunged back below 70 as traders returned from the holiday weekend. After taking out the psychological 70 threshold, bears manag...